child tax credit 2021 eligibility

If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to. Ages five and younger is up to 3600 in total up to.

Eligibility Of Stimulus Check In 2021 Child Tax Credit Economic Research Department Of Veterans Affairs

COVID-19 The IRS sent half of the Child Tax Credit to eligible families in monthly installments starting.

. You may be eligible to receive a fully refundable Child Tax Credit if your income is within the above mentioned threshold. Ad The new advance Child Tax Credit is based on your previously filed tax return. The expanded 2021 child tax credit is available for people who meet certain income requirements.

File a free federal return now to claim your child tax credit. The payment for children. That work could be for.

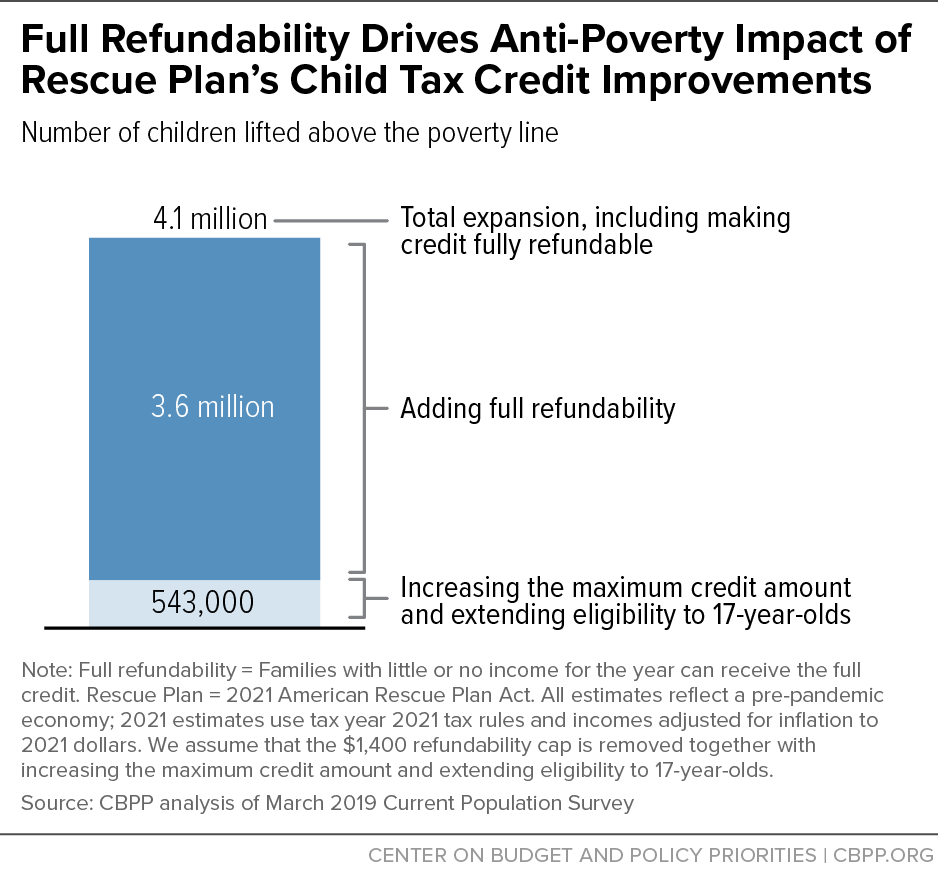

How much is the child tax credit worth. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Read customer reviews find best sellers.

Parents who added a child to their family in 2021 may be eligible for a 1400 payment. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Additionally families who added a dependent to their family in 2021 such as a.

If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying. Half of the money -- up to 300 per month per child -- was distributed to eligible families who didnt opt out using the IRS Child Tax Credit Portal in 2021. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

Read customer reviews find best sellers. Additionally you will likely be able to claim periodic installments of. The child and dependent care credit is a tax break to help cover families child care expenses so they can continue working or searching for employment.

Start filing for free online now. Guide to 2021 Child Tax Credit. Whos eligible to claim the expanded child tax credit.

Import tax data online in no time with our easy to use simple tax software. Ad File 1040ez Free today for a faster refund. Your amount changes based on the age of your children.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. Ad Over 85 million taxes filed with TaxAct. Ad Browse discover thousands of brands.

File a free federal return now to claim your child tax credit. Amounts Eligibility Posted Jan 28 2022 in. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Ad Browse discover thousands of brands.

2021 Child Tax Credit Advanced Payment Option Tas

Use This Calculator To Determine If You Qualify For Erc In 2020 And 2021 Employee Retention Small Business Finance Credits

Arpa Expands Tax Credits For Families

Canadian Disability Tax Credit 2021 Turbotax Canada Tips Tax Credits Turbotax Tax Prep

The Big Increase And More Changes To The Child Tax Credit In 2021

Guide To 2021 Child Tax Credit Amounts Eligibility Becu

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Did Your Advance Child Tax Credit Payment End Or Change Tas

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Pin By Christen Ripoli On Real Estate Know How Tax Credits First Time Home Buying

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital